Case Study:

Cutting Off Recruitment Marketing When Freight Slows Down is Risky

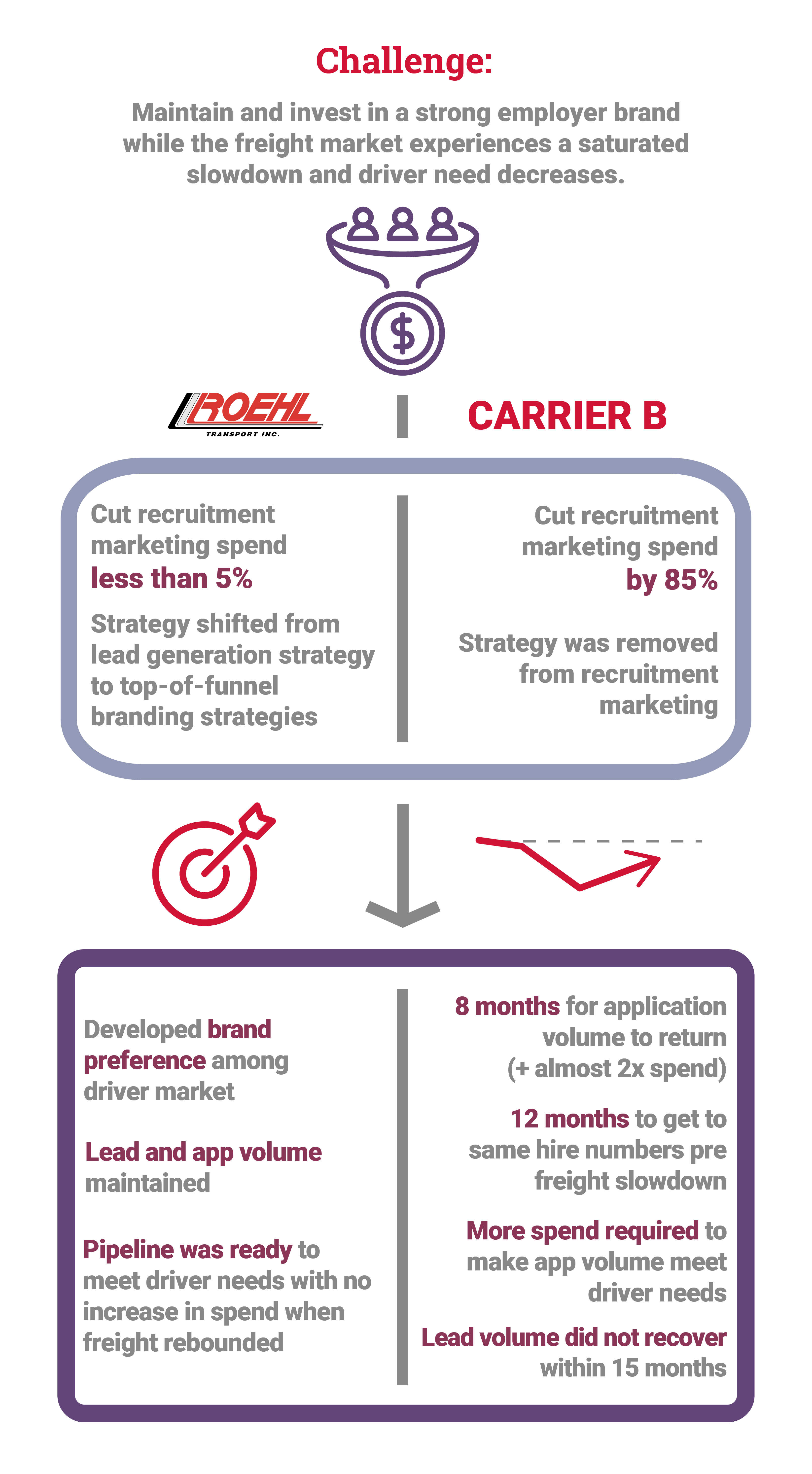

Challenge:

Roehl Transport vs. Carrier B

As a response to the freight market slowdown, the team of Roehl Transport made the decision to remain invested in the carrier’s employer brand – even when their driver needs decreased.

Conversely, Carrier B dramatically cut off investment in recruitment marketing upon a decrease in driver needs. The challenge was to maintain and invest in a strong employer brand while the freight market experienced a saturated slowdown and driver need decreased.

Solution:

To tackle the challenge, Roehl cut recruitment marketing spend less than 5% for four months. The team’s strategy shifted from lead generation to top-of-funnel branding. Leads increased by 19% during that four-month period, and Roehl maintained a strong driver pipeline. At five months, they continued to maintain recruitment marketing spend.

At Carrier B, recruitment marketing spend was cut by 85%, and strategy was removed from recruitment marketing. They lost 96% of lead volume in four months, and their driver pipeline was drained. At five months, they doubled spend on recruitment marketing to rebuild the driver pipeline, and by month eight, driver needs demanded 42% more spend than pre freight slowdown.

Results:

When freight slows down, historical data shows that when the rebound occurs, driver needs accelerate rapidly, and carriers who continue to invest in their employer brand win in driver recruiting. Roehl Transport developed a brand preference among the driver market and maintained their lead and app volume when freight rebounded quickly so that the pipeline was ready to meet driver needs without increasing spend. Carrier B saw an eight-month gap before their application volume returned and a 12-month gap before their hire numbers were the same pre-freight slowdown. This required more spend, and 15 months after cutting recruitment marketing spend, lead volume had still not fully recovered.